32+ Mortgage calculator 10 year term

For example with 51 ARM expect to see a reduced rate for the first 5 years of the loan during the fixed-rate introductory phase. Use our Ontario mortgage calculator to determine your monthly mortgage payment for your home purchase in Ontario.

Brute Force Attack Detection Using Wireshark 32 Pages Solution In Google Sheet 810kb Latest Update Vincent Study For Exams

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel.

. Do not underestimate the one extra payment a year for your mortgage because it can save you. The mortgage amount rate type fixed or variable term amortization period and payment frequency. Mortgage type The mortgage type includes the term of the mortgage between 1-10 years and the rate type variable or fixed.

58 of borrowers choose a 2-year deal period while 32 opt for a 5-year deal period. 10-year mortgages tend to be priced at roughly 05 to 10 lower than 30-year mortgages. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000.

Across the United States 88 of home buyers finance their purchases with a mortgage. The mortgage term is the length of time you commit to the terms conditions. The discount point also corresponds to the fixed-rate period of the ARM.

The following table shows the rates for ARM loans which reset after the fifth year. Todays national mortgage rate trends. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Use our Alberta mortgage calculator to determine your monthly mortgage payment for your home purchase in Alberta. Mortgage Term years Total Interest. As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR.

Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of. The term of your mortgage a 30 year mortgage is most common.

5 or 6 then initial payments on a 25-year loan term go mostly toward interest. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

Jan 31 2038. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. The most common home loan term in the US is the 30-year fixed rate mortgage.

Historical 30-YR Mortgage Rates. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D. Mortgage type The mortgage type includes the term of the mortgage between 1-10 years and the rate type variable or fixed.

By the end of the mortgage term in the year 2033 by contrast the interest payment would be only 189 and the principal would be a whopping 41187. Mortgage payment calculator with Scotiabank mortgage rates. Fixed-rate mortgage interest rate and annual percentage rate APR For graduated-payment or stepped-rate mortgages use the ARM columns.

If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

The above calculator is for fixed-rate mortgages. Current 5-Year Hybrid ARM Rates. Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison.

Well explain how you can this below. To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. Simple Mortgage Calculator.

If rates are low like they currently are. Besides monthly mortgage payments you can choose a bi-weekly payment schedule. Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided.

This will greatly lower your overall interest. You can consider refinancing it to a 15-year term. NerdWallets calculator helps you determine if renting or buying a home makes more financial sense for you.

This printable amortization schedule will help you to get a month by month calendar of exactly how much of your monthly income will be devoted to paying off your mortgage. Use our BC mortgage calculator to determine your monthly mortgage payment for your home purchase in BC. This payment method can cut years.

15-year FRMs also come with lower rates by around 025 to 1 than 30-year FRMs. In many countries 25-year mortgages are structured as adjustable or variable rate loans which reset annually after a 2 3 5 or 10 year introductory period with a teaser rate. View the corresponding down payment property taxes and amortization schedule.

The mortgage term is the length of time you commit to the terms conditions and mortgage rate with a. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. For a 15-year FRM thats 180 monthly payments throughout 15 years.

Mortgage Amount Interest Rate Mortgage Term years. Because its a fixed payment schedule if you factor in additional payments you can actually reduce your payment time. You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options.

The mortgage amount rate type fixed or variable term amortization period and payment frequency. Second mortgage types Lump sum. For today Tuesday September 06 2022 the current average rate for the benchmark 30-year fixed mortgage is 605 up 16 basis points since the same time.

The following table lists historical average annual mortgage rates for conforming 30-year mortgages. Furthermore compared to a 30-year FRM you save tens and thousands on interest charges with a 15-year FRM. Browse NatWest mortgage deals use our NatWest mortgage calculator to calculate the best rates and repayment costs and get customers views.

The mortgage term is the length of time you commit to the terms conditions and mortgage rate with a specific. Mortgage type The mortgage type includes the term of the mortgage between 1-10 years and the rate type variable or fixed. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of.

Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided. The mortgage term is the length of time you commit to the terms conditions and mortgage rate with a. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment.

Likewise for a 101 ARM your interest rate will be decreased for the first 10 years of the mortgage. Mortgage type The mortgage type includes the term of the mortgage between 1-10 years and the rate type variable or fixed. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

44565 Terwilliger Rd Anza Ca 92539 Mls 210032007 Redfin

32 Expense Sheet Templates In Pdf Free Premium Templates

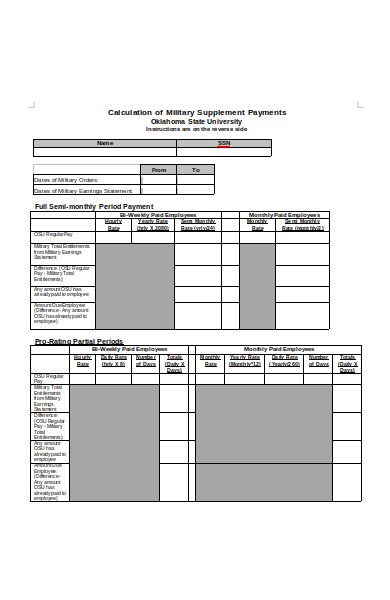

Free 31 Calculation Forms In Pdf Ms Word

Brute Force Attack Detection Using Wireshark 32 Pages Solution In Google Sheet 810kb Latest Update Vincent Study For Exams

35 Expense Report Templates Word Pdf Excel Free Premium Templates

Free 32 Receipt Samples In Pdf Ms Word

41 Expense Report Templates Word Pdf Excel Free Premium Templates

Environmental Valuation Cost Benefit News January 2017

21 Expense Report Form Templates Google Docs Word Pages Pdf Free Premium Templates

Explore Our Sample Of Real Estate Investment Analysis Template Investment Analysis Spreadsheet Template Investing

3443 W 17th Ave Spokane Wa 99224 Mls 202221778

Study Checklist Printable Planner Study Tracker Study List Etsy Student Planner Printable Student Planner Exam Planner

2630 E 33rd Ave Spokane Wa 99223 Mls 202221310 Redfin

Kinglet Plan At Cross Creek Ranch 45 In Fulshear Tx By Tri Pointe Homes

30 Best Business Accountants Bookkeepers In Richmond Melbourne 2022

5403 N Ainsworth Ln Spokane Wa 99217 Realtor Com

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss